How Fine Silver Mint Protects Against Financial Downfalls

Safeguarding Economies with Fine Silver Mint

By: Silver Coin Surplus and Fine Silver Mint Studies

Date: July 3, 2024

The Fine Silver Mint Defense Against Economic Decline

In an age of economic uncertainty, people seek a sense of stability and security for their financial futures and fine silver mint has been the answer. Fine silver has long been considered a safe haven for investors seeking refuge from economic downturns, and its significance remains unwavering in 2024. As the global economy continues to navigate through various challenges, the allure of fine silver as a safeguard against economic turmoil becomes increasingly apparent.

Fine silver mint, with its intrinsic value and enduring appeal, offers a compelling case for investment. Unlike traditional currencies, which are subject to inflation and devaluation, silver and other precious metals maintain purchasing power over time. Such stability is particularly noteworthy in light of the current economic climate, where volatility and fluctuating markets have become the norm. As a tangible asset, fine silver provides a hedge against currency depreciation and serves as a reliable store of value, a fact that has not gone unnoticed by astute investors.

Moreover, the diverse utility of fine silver mint adds to its appeal as an investment venue. Beyond its intrinsic value as a precious metal, silver is indispensably used in a myriad of industries, including electronics, healthcare, and renewable energy. The dual nature of silver, as both an investment asset and an international commodity, further underlines its resilience and versatility in the face of economic challenges. As global demand for silver continues to rise, driven by technological advancements and sustainable initiatives, the long-term prospects for silver as a strategic investment are decidedly promising.

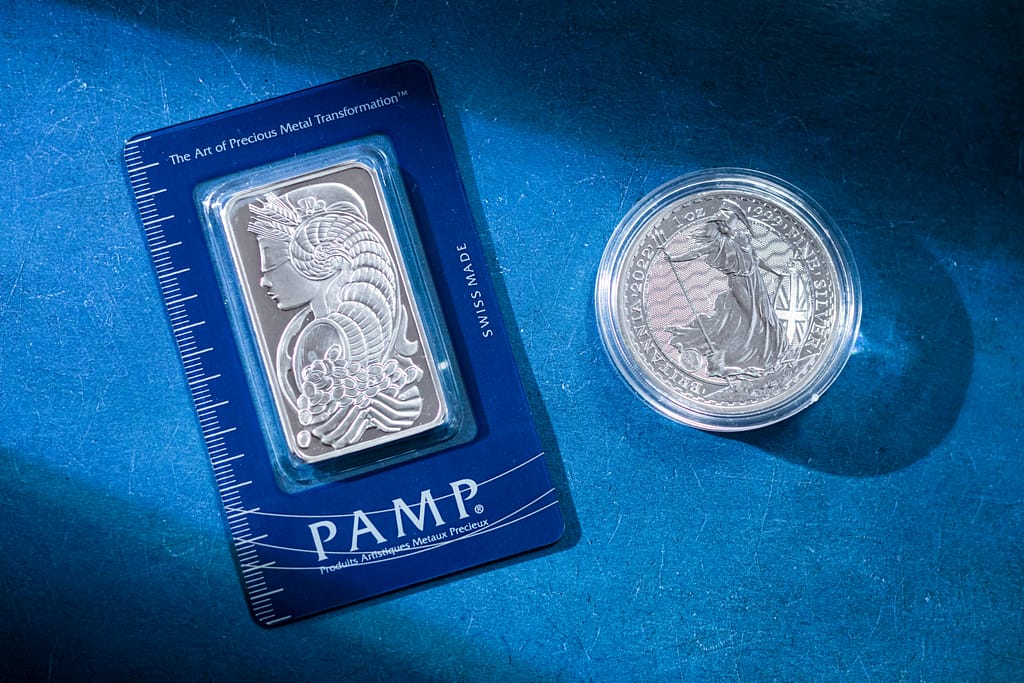

The iconic allure of fine silver, with its timeless beauty and storied history, imparts a sense of prestige and desirability that transcends economic fluctuations even in 2024. Fine silver coins and bars, with their exquisite craftsmanship and enduring luster, hold an inherent appeal for collectors and investors alike. Beyond its investment potential, fine silver also embodies a tangible link to the past, evoking a sense of nostalgia and cultural significance that is cherished by many.

In the context of contemporary financial planning, the inclusion of fine silver in one’s investment portfolio serves as a prudent diversification strategy. By allocating a portion of one’s assets to physical silver, investors can mitigate risks associated with traditional investments and reinforce their overall financial resilience. With a careful balance of assets, investors can fortify their portfolios against the perils of economic downturns and create a foundation of stability in an uncertain world.

Looking ahead to 2024 and beyond, the imperative to invest in fine silver becomes increasingly pronounced. As the global economy navigates through the complexities of a rapidly evolving landscape, prudent investors recognize the enduring value of fine silver as a stronghold against economic volatility. By safeguarding one’s financial well-being through astute allocation of resources, individuals can secure a tangible pathway towards long-term prosperity and peace of mind.

In conclusion, the intrinsic qualities of fine silver mint, coupled with its enduring appeal and multifaceted utility, position it as a stalwart defense against economic turbulence. As discerning investors, embracing the significance of fine silver in 2024 becomes a pivotal step towards fortifying our financial foundations and ensuring a resilient path towards prosperity.