The Value of Silver Commodity Shift in 2024

Precious Metals Boom on the Horizon

By: Silver Coin Surplus and the Value of Silver Research Report

Date: August 28, 2024

Exploring the Reasons Behind the 24% Surge in Silver Value

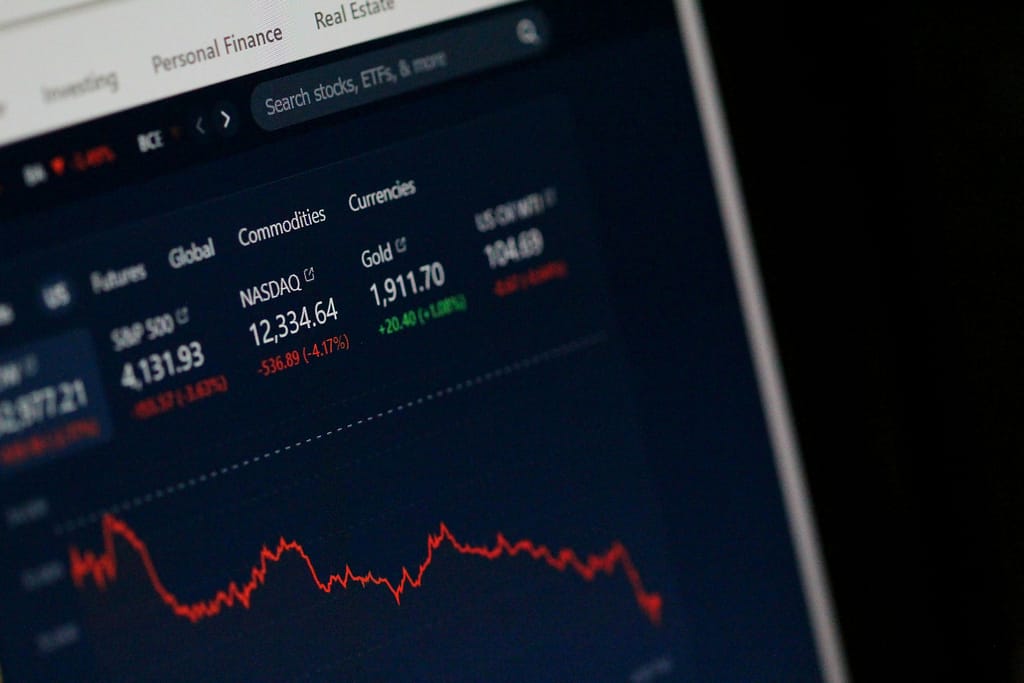

In recent times, the value of silver has experienced a significant increase, causing a stir in the world of commodities. Investors and analysts have been closely monitoring this shift, examining the various factors contributing to this surge in value. Understanding the dynamics of supply and demand in world trade is crucial in comprehending the fluctuations in the precious metals market, particularly silver.

Supply and demand play pivotal roles in the determination of silver’s value. As the demand for silver rises, driven by factors such as industrial and technological applications, as well as investment purposes, the available supply becomes subject to heightened scrutiny. One of the primary factors impacting silver’s supply is the mining industry. Silver is predominantly obtained as a by-product of other metal extraction, such as copper and gold. The variations in the production of these primary metals directly influence the supply of silver, adding complexity to the dynamics of the market.

In 2024, the global economy witnessed a surge in demand for silver due to its diverse uses across industries. The escalating adoption of renewable energy technologies, particularly solar panels, contributed significantly to the heightened demand for silver, given its indispensable role in these applications. Furthermore, the increasing integration of silver in the healthcare sector, specifically in the production of antimicrobial materials, bolstered its demand, creating a positive outlook for the metal. These trends, coupled with the enduring charm of silver as a safe-haven investment, sparked a notable increase in its market value.

On the supply side, the challenges faced by the mining industry further accentuated the dynamics of the value of silver. Factors such as labor issues, regulatory constraints, and environmental considerations imposed constraints on the extraction and production of silver. The decline in primary metal mining, to which silver production is intricately linked, exacerbated supply constraints, triggering a greater reliance on existing silver stockpiles and recycling processes to meet the growing demand.

Another critical catalyst in the value of silver escalation is its role as a hedge against inflation and economic uncertainty. Amid geopolitical tensions, fluctuating currencies, and global economic shifts, investors sought refuge in precious metals, propelling a surge in demand. The allure of pure silver as a more affordable alternative to gold further fueled its demand among individual and institutional investors alike.

The interplay between these supply and demand dynamics underscores the complex nature of the commodities market and its susceptibility to external stimuli. While the recent surge in the value of silver reflects the contemporary landscape, it also serves as a reminder of the intricate relationship between global events and the commodities that underpin economies.

Looking ahead, it is imperative for stakeholders and market participants to remain vigilant and adaptive in navigating the ever-evolving terrain of precious metals. The fine silver value, like other commodities, will continue to be shaped by an amalgam of macroeconomic factors, technological advancements, and geopolitical developments. By comprehensively understanding the commodity shifts for precious metals, particularly in the context of supply and demand in world trade, we can better equip ourselves to interpret and respond to the fluctuations in their values and the inherent opportunities they present.